Samsung Reclaims Leadership in Global Market, Apple Strengthens Second Place

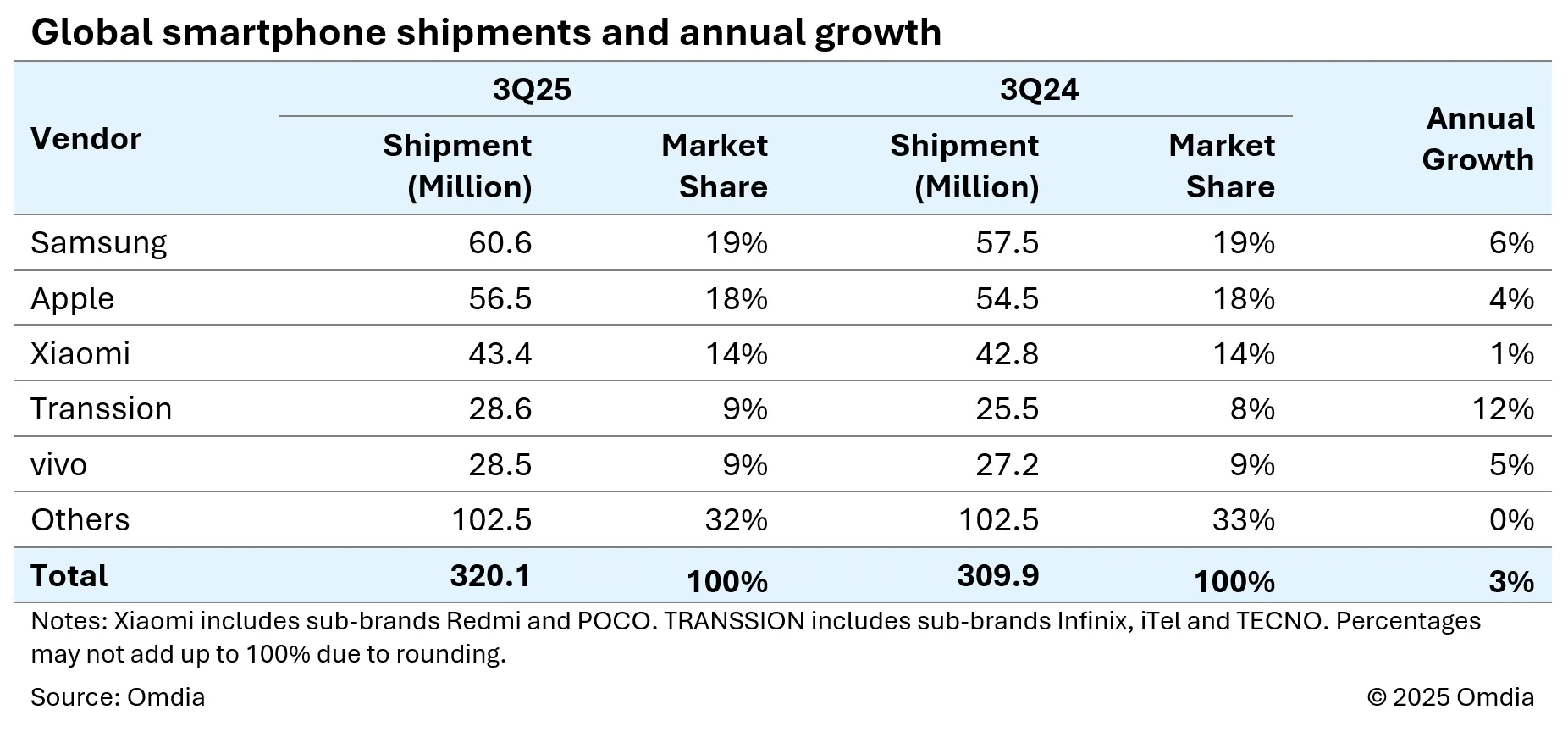

The global smartphone market is finally showing signs of recovery. According to the latest report from Omdia, 320.1 million smartphones were shipped in Q3 2025, marking an annual growth of 3% — a notable improvement after a lackluster start to the year.

However, behind this modest recovery lies an unexpected twist: Transsion, the Chinese company behind Tecno, Infinix, and Itel, is now the fastest-growing manufacturer in the world.

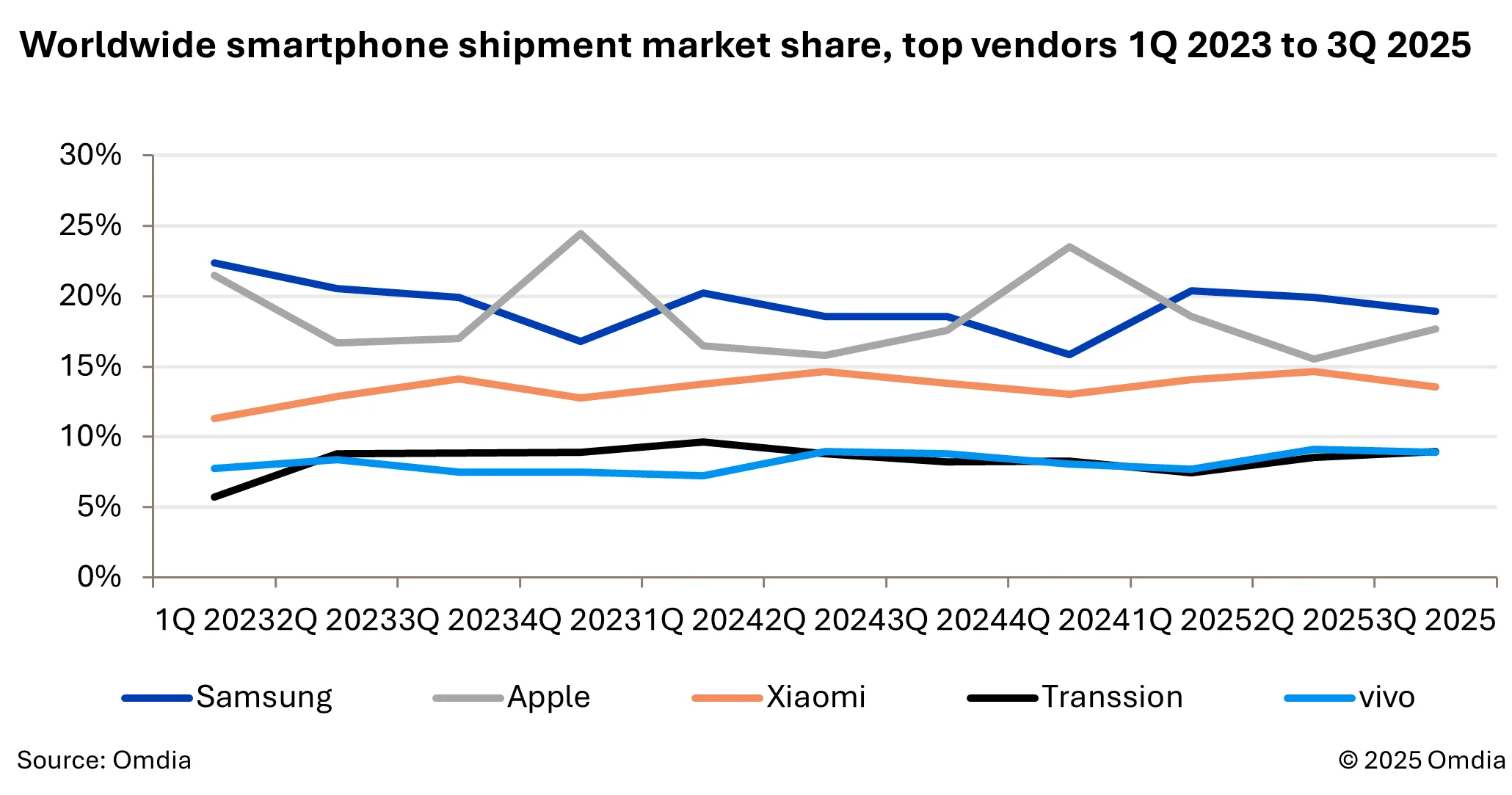

Samsung Reclaims the Top Spot Globally

With 60.6 million units shipped in Q3 2025, Samsung maintains its position as the world’s number one, accounting for 19% of the market. The South Korean giant is buoyed by the surprising success of its Galaxy Z Fold 7 and Z Flip 7 foldable devices, along with new entry-level and mid-range models like the Galaxy A07 and A17.

These results reinforce Samsung’s “dual-line” strategy: innovating in the premium segment while solidifying its dominance in the affordable category.

Apple in Second Place with Moderate Growth

Apple ranks second with 56.5 million shipments, marking a 4% year-on-year growth.

The success of the iPhone 17, particularly the base model, has exceeded expectations, while demand for the iPhone 17 Pro and Pro Max remains strong.

The iPhone 17 marks a turning point, as Apple has integrated ProMotion technology and a 48 MP ultra-wide camera into its standard model for the first time.

Top 5 Manufacturers Worldwide

Transsion’s Rapid Rise from Africa and Asia

The real star of the quarter is Transsion. With 28.6 million smartphones shipped, the company achieved a 12% year-on-year growth and climbed to fourth place globally, outperforming Oppo and Honor.

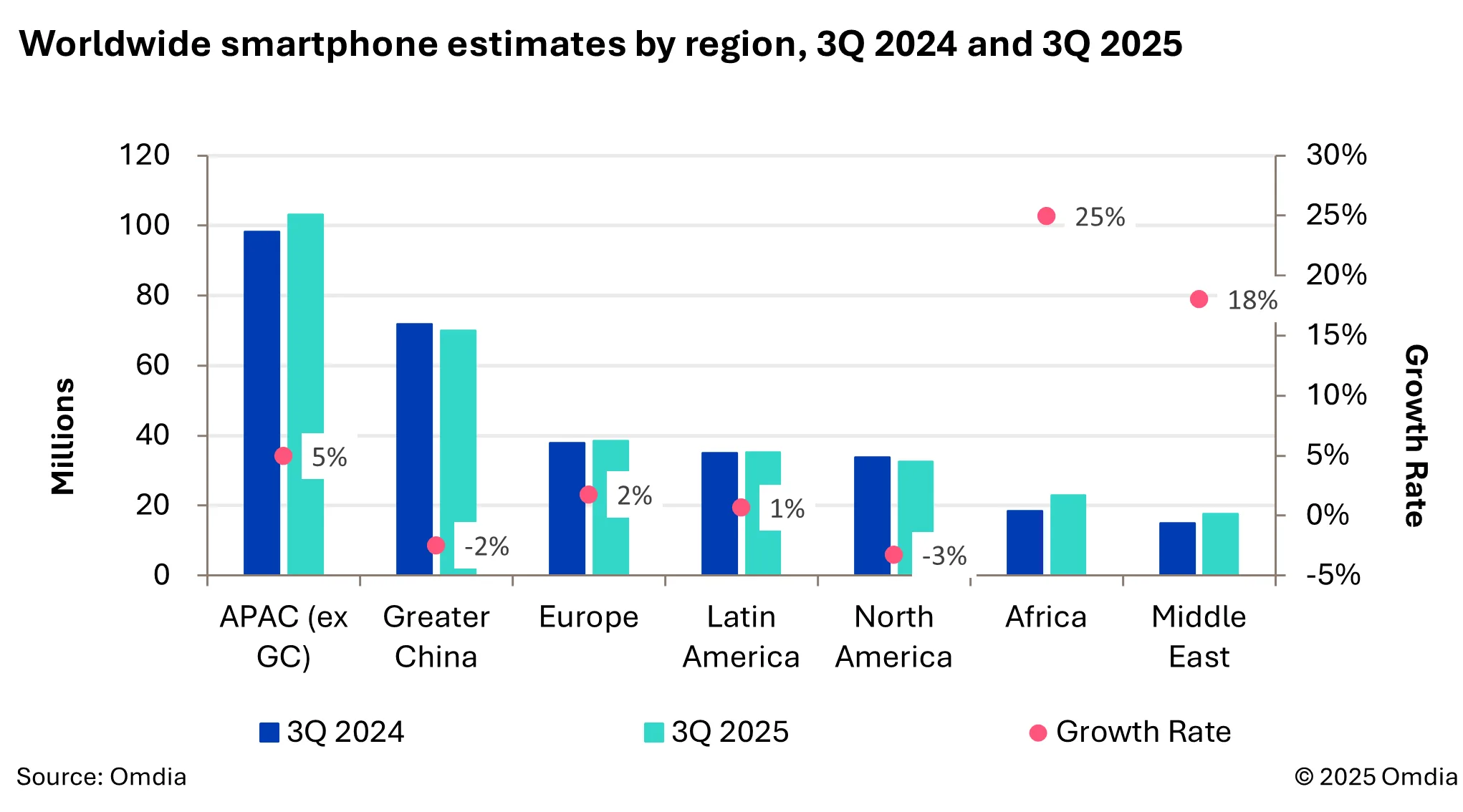

Transsion now dominates the emerging markets of Africa, South Asia, and the Middle East, thanks to ultra-affordable smartphones tailored for these regions (features like cameras optimized for darker skin tones, dual SIM support, and long battery life).

In Africa, nearly one in two smartphones sold now comes from a Transsion brand (Tecno, Infinix, or Itel).

A Market Driven by Extremes: Budget and Premium

According to Omdia, the current growth relies on two opposing segments:

- Smartphones priced under $100, dominated by Transsion, Realme, and Redmi,

- And premium models priced over $700, where Apple and Samsung remain unbeatable.

Mid-range markets ($300–700) continue to stagnate, as consumers prefer either to spend as little as possible or invest more in a durable premium device.

“It’s all or nothing,” comments Omdia. “Users are looking for either the best deal possible or a device they will keep for five years or more.”

This polarization reflects a profound change in consumer behavior:

- In emerging markets, the race for the cheapest smartphone is still dominant, fueled by Transsion, Xiaomi, and Realme.

- In mature markets, the rise of durable premium devices (iPhone, Galaxy Ultra, Pixel Pro) is becoming evident, supported by lengthy software support and trade-in offers.

Outlook for the End of 2025

Omdia predicts continued recovery in Q4, driven by iPhone 17 sales for the holiday season, increased shipments of foldable smartphones, and the rise of Chinese brands in emerging markets.

The global market could surpass 1.2 billion shipments in 2025, reflecting a 2-3% year-on-year increase — a tangible first sign of recovery after two years of stagnation.

The global smartphone market is finally on the rise again. Samsung retains its crown, Apple strengthens its position, but it’s Transsion — the quiet champion of emerging markets — that steals the spotlight with double-digit growth. This indicates that the future of mobile is as much about Lagos and Mumbai as it is about Cupertino or Seoul.