Samsung Doubles Its Profits: Semiconductors and AI Save the South Korean Giant

Samsung has just released its financial results for the third quarter of 2025, and it’s clear that the South Korean giant is experiencing a remarkable return to growth.

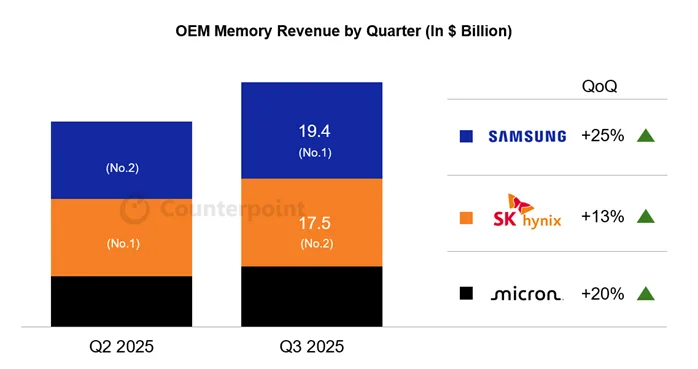

Driven by a massive rebound in its semiconductor business, the company has exceeded profit expectations and regained its position as the global leader in memory.

Solid financial results:

- Revenue (Q3 2025): 86.1 trillion won (~$60.5 billion), an increase of 8.85% year-on-year.

- Operating profit: 12.2 trillion won (~$8.59 billion), which is +32.9% compared to 2024 and +160% compared to the previous quarter.

- Quarterly revenues: +15.5% sequentially.

These figures surpass analyst estimates and highlight a strong comeback after a more challenging second quarter.

Samsung: Semiconductors Back in the Green

The true driver of this recovery is the Device Solutions division, which encompasses memory, chip design, and foundry operations.

- Revenue: 33.1 trillion won (~$23 billion), up 13% year-on-year.

- Operating profit: 7 trillion won (~$4.9 billion), an 81% year-on-year increase and a tenfold rise compared to Q2.

This performance is attributed to the rising demand for HBM (High Bandwidth Memory) chips used in AI servers, a sector previously dominated by SK Hynix. Samsung has reclaimed its position as the global leader in the DRAM and NAND memory markets, according to Counterpoint Research.

“We expect the semiconductor market to remain strong in the first half of 2026, supported by robust AI-related demand,” stated Samsung in a press release.

Mobile and Network Division Also Making Gains

The Mobile Experience & Network segment (smartphones, tablets, wearables) has also performed well:

- Operating profit: 3.6 trillion won (~$2.53 billion), up 28% year-on-year.

- Sales were boosted by the Galaxy Z Fold 7 and the strong performance of the Galaxy S25 range.

AI as the Future Growth Engine

Samsung is now focusing on the exponential growth of artificial intelligence to drive two of its core businesses:

- Semiconductors, through the production of memory chips and processors optimized for AI servers.

- Consumer devices, by integrating AI tools into its smartphones, tablets, and televisions.

A spokesperson said during the conference: “The demand for AI servers now far exceeds the industry’s supply. Investments in AI infrastructure will continue to grow.”

In the Stock Market

The announcement had an immediate positive effect on stock prices:

- +3,000 won (+3%) to 103,500 KRW (~$72.9).

- Close to the 52-week high of 105,800 KRW (~$74.3).

Samsung confirms its remarkable recovery. After a downturn caused by the semiconductor slowdown, the company is now fully capitalizing on the global rush toward artificial intelligence—a strategic pivot that is expected to continue fueling its growth in 2026.